(Disponible en français)

Table of Contents

You can use this form to apply to the Landlord and Tenant Board (LTB) to vary the amount of a rent reduction if:

You must apply on or before the later of:

Read these instructions before completing the application form. You are responsible for ensuring that your application is correct and complete. Follow the instructions carefully when you complete the application form.

The information you fill in on the form will be read electronically; therefore, it is important to follow the instructions below:

Shade the appropriate circle to indicate whether you are a landlord or a tenant.

Fill in your name and address. If the landlord is a company, fill in the name of the company under "Company Name". Include both daytime and evening telephone numbers and a fax number and e-mail address if you have them.

If there is more than one landlord, fill in information about one of the landlords in this section. Provide the names, addresses and telephone numbers of the additional landlords on the Schedule of Parties Form which is available from the LTB website at tribunalsontario.ca/ltb.

Fill in your name and address if it is different from the address of the rental unit covered by this application. Include both daytime and evening telephone numbers and a fax number and e-mail address if you have them.

If two or more tenants are applying, provide the names, addresses and telephone numbers of any additional tenants on the Schedule of Parties Form which is available from the LTB website at tribunalsontario.ca/ltb.

Fill in the street address for each building in the residential complex covered by this application. Attach additional sheets if necessary. If you are a tenant, fill in the unit number of the rental unit subject to the application.

If the street name includes a direction that will not fit in the five spaces provided (such as Northeast) use the following abbreviations: NE for Northeast, NW for Northwest, SE for Southeast, SW for Southwest.

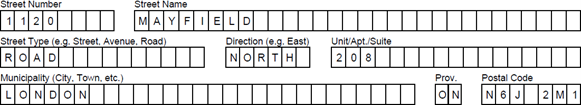

Example:

If the address is: #208 at 1120 Mayfield Road North, London, this is how you should complete Part 1 of the application:

Shade the appropriate circle to indicate whether the other parties to the application are a landlord or a tenant.

If you are the tenant, fill in the landlord's name and mailing address. If the landlord is a company, fill in the name of the company under "Company Name". Include the landlord's daytime and evening telephone numbers, fax number and e-mail address if you have them.

If you are the landlord and the application affects only one rental unit, fill in the tenant's name and mailing address. Include the tenant's daytime and evening telephone numbers, fax number and e-mail address if you have them.

If the application affects more than one rental unit, fill in information about one of the tenants in this section of Part 1. Provide the names, addresses and telephone numbers of the additional other parties on the Schedule of Parties Form which is available from the LTB website at tribunalsontario.ca/ltb.

If there are any other applications that relate to this rental unit, and those applications have not been resolved, fill in the file numbers in the space provided.

In order to decide whether to vary the amount of the rent reduction set out in a Notice of Rent Reduction, the LTB needs to know the municipal property taxes for the complex for the "base year" and the "reference year" for the application. The base year is the taxation year in which the taxes decreased. The reference year is the calendar year immediately before the base year.

For example, if the taxes decreased in 2015, the rent reduction set out in the Notice of Rent Reduction would be effective December 31, 2014. The base year for the application would be 2014 and the reference year would be 2013.

Fill in the base year and the reference year. Then, fill in the total amount of municipal property taxes for the residential complex for the base year and the reference year. Include only the actual property and education taxes levied on the complex. Do not include other charges the municipality has levied on the landlord such as special levies, penalty charges, charges for work carried out by the municipality, user fees, etc.

You must attach to the application evidence of the amount of property taxes charged by the municipality for both the base year and the reference year.

Shade the box, or boxes, next to your reasons for applying to the LTB.

Reason 1: When the municipality calculates the percentage rent reduction, it does not include other charges the municipality levied on the landlord. You can apply for this reason if the landlord paid charges to the municipality which were not included by the municipality when it calculated the percentage rent reduction and you believe these charges should be included when calculating the rent reduction.

When calculating the amount of the rent reduction, the LTB will not take into account the following:

However, the LTB can consider charges such as:

In the table on the form under Reason 1, fill in the base year and reference year and fill in the total charges the landlord paid to the municipality that the municipality did not include when it calculated the percentage rent reduction.

Reason 2: You can apply for this reason if you would like the LTB to calculate the percentage rent reduction taking into account the rent revenue for the residential complex.

There are two different formulas used by municipalities to calculate the percentage rent reduction set out in a Notice of Rent Reduction.

One formula applies if the residential complex falls under the multi-residential property tax class as defined under the Assessment Act. In this case the municipality calculates the percentage rent reduction by multiplying the percentage decrease in taxes for the complex by 20%. The formula is based on the assumption that landlords of residential complexes in the multi-residential property tax class typically pay about 20% of their total annual rent revenue in municipal property taxes.

The second formula applies if the residential complex does not fall under the multi- residential property tax class as defined under the Assessment Act. In this case, the municipality calculates the percentage rent reduction by multiplying the percentage decrease in taxes for the complex by 15%. The formula is based on the assumption that landlords of residential complexes that are not in the multi-residential property tax class typically pay about 15% of their total annual rent revenue in municipal property taxes.

If the amount that a landlord pays for municipal property taxes, as a percentage of the annual rent revenue for the residential complex, is not equal to the percentage that the municipality used in the formula for calculating the percentage rent reduction (either 20% or 15% depending on the property tax class for the residential complex), then the LTB can calculate the percentage rent reduction based on the total annual rent revenue for the complex.

If you are applying for Reason 2, also shade the appropriate circle to indicate whether or not the residential complex falls under the multi-residential property tax class.

If you apply for this reason, you must fill in Part 4: Information About Rent Revenue.

Reason 3: You can apply for this reason if you believe the municipality made an error in calculating the percentage rent reduction and setting it out in the Notice of Rent Reduction.

In the box provided, explain why you believe there is an error. Be as specific as possible. Include what you believe to be the correct percentage rent reduction and explain how you calculated this amount. You should also file with the application any evidence you have supporting your belief that there was an error.

Reason 4: You can apply for this reason if the municipal property taxes for the base year were either increased or decreased after the municipality gave the Notice of Rent Reduction. The municipal property taxes for the base year for a complex could be changed after the notices of rent reduction are sent out if the assessment for the complex was reconsidered or an appeal decision was made.

You can apply for this reason if the property taxes were changed before March 31st of the year after the date the rent reduction took effect. You must include evidence showing the increase or decrease in property taxes.

If you applied for Reason 2, you must complete this part of the form by filling in the total annual rent revenue for the complex for the base year. In this case, the LTB must calculate the percentage rent reduction based on the total annual rent revenue. If you apply for Reason 2 and you do not fill in this part of the form, the LTB cannot consider your application.

If you applied for any other reason, you should fill out this part if you want the LTB to calculate the percentage rent reduction based on the total annual rent revenue for the complex, rather than the formula used by the municipality.

If you are the landlord, shade the circle marked "Landlord". Then, sign the application form and fill in the date.

If you are the tenant, shade the circle marked "Tenant". Then, sign the application form and fill in the date.

If you are the representative, shade the circle marked "Representative". Then, sign the application form and fill in the date.

Complete this section only if you are a representative. Fill in your name, address and contact information in the spaces provided.

The LTB wants to ensure that everyone who uses its services can ask for and receive accommodation and/or French Language services in order to be able to participate in its proceedings on an equal basis.

Shade the appropriate box or boxes on the form to indicate whether you need accommodation under the Ontario Human Rights Code, French-language services or both. The LTB will not include a copy of this form when we give the other parties a copy of the application form. However, the information will be included in your application file. The file may be viewed by other parties to the application.

If you require accommodation under the Human Rights Code, explain what services you need in the space provided.

Complete this form to provide the LTB with the information required to process your application. Your application will not be accepted if you do not pay the application fee at the time you file the application. If you owe money to the LTB as a result of failing to pay a fee or any fine or costs set out in an order, your application may be refused or discontinued.

You may request a fee waiver if you meet the financial eligibility requirements set out by the LTB. You will need to complete the Fee Waiver Form which is available from the LTB website at tribunalsontario.ca/ltb. For more information about fee waivers and the eligibility criteria, go to the fee waiver rules and practice direction on the Rules of Practice page of the LTB website.

Shade the appropriate box to show whether you are paying by online payment, money order, certified cheque, Visa or MasterCard. You can pay online using a debit or credit card. If you pay online, email your receipt and application to LTBpayments@ontario.ca.

If you are filing my mail or courier, you can pay by credit card by completing the Credit Card Payment Form and submitting it with your application. You cannot pay by cash or debit card if you are filing your application by mail or courier.

To file this application, you must include the following:

Your application will be refused if you do not pay the application fee.

You can file your application in one of the following ways:

You can pay online using a debit or credit card. If you pay online, email your receipt and application to LTBpayments@ontario.ca.

Mail or courier your A4 application to the nearest LTB office.

To find a list of LTB office locations visit the LTB website at tribunalsontario.ca/ltb. You can also call the LTB at 416-645-8080 or 1-888-332-3234 (toll-free).

If you mail or courier your application, you can pay the application fee by certified cheque, money order, Visa or MasterCard. Certified cheques and money orders must be made payable to the Minister of Finance. If you are filing by mail or courier and paying by Visa or Mastercard, you must complete the Credit Card Payment Form and submit it with your application.

Effective December 31, 2021, the LTB has decommissioned its fax machines assigned to regional offices. This means that except for a limited number of circumstances, the LTB no longer accepts documents, including applications, by fax.

If you must use fax to file applications or submit documents urgently because you don't have access to a computer and/or internet or can't visit a local ServiceOntario office, applicants can fax applications and documents that don't have a fee associated, or where they are eligible for a fee waiver, to 1-833-610-2242 or (416) 326-6455.

Due to Payment Card Industry (PCI) security compliance requirements, the LTB cannot accept credit card payment via fax. Applications with credit card information will be automatically deleted and not processed.

Please contact the LTB at 1-888-332-3234 for information on how to submit payment information.

You can visit the LTB website at: tribunalsontario.ca/ltb.

You can call the LTB at 416-645-8080 from within the Toronto calling area, or toll-free at 1-888-332-3234 from outside Toronto, and speak to one of our Customer Service Officers.

Customer Service Officers are available Monday to Friday, except holidays, from 8:30 a.m. to 5:00 p.m. They can provide you with information about the Residential Tenancies Act and the LTB's processes; they cannot provide you with legal advice. You can also access our automated information menu at the same numbers listed above 24 hours a day, 7 days a week.